Climate finance is the engine driving the global shift toward a cleaner, more resilient economy. This dynamic blends public funds, private capital, and innovative instruments to mobilize trillions for reducing emissions, adapting to climate impacts, and supporting sustainable finance and development. For newcomers, climate finance explained can feel abstract, but its practical impact is visible in cleaner energy, resilient infrastructure, and healthier communities. In this article we outline its mechanisms and show how investors, governments, and businesses can participate in funding the transition to a greener future. By highlighting green bonds, blended finance for climate, and public finance for climate action, we connect theory to action.

From a different angle, this flow of money is often described as climate-related funding, environmental finance, or green investment capital. Descriptors like sustainable finance, low-carbon investments, and risk-sharing instruments help articulate how capital aligns with emissions reductions and adaptation goals. Public–private partnerships, concessional loans, and grant-backed de-risking tools illustrate how policy and philanthropy catalyze private participation. By using this varied vocabulary, policymakers, investors, and communities can assess opportunities, monitor impact, and scale climate action responsibly.

Climate Finance Explained: Public, Private, and Blended Funds Power the Green Transition

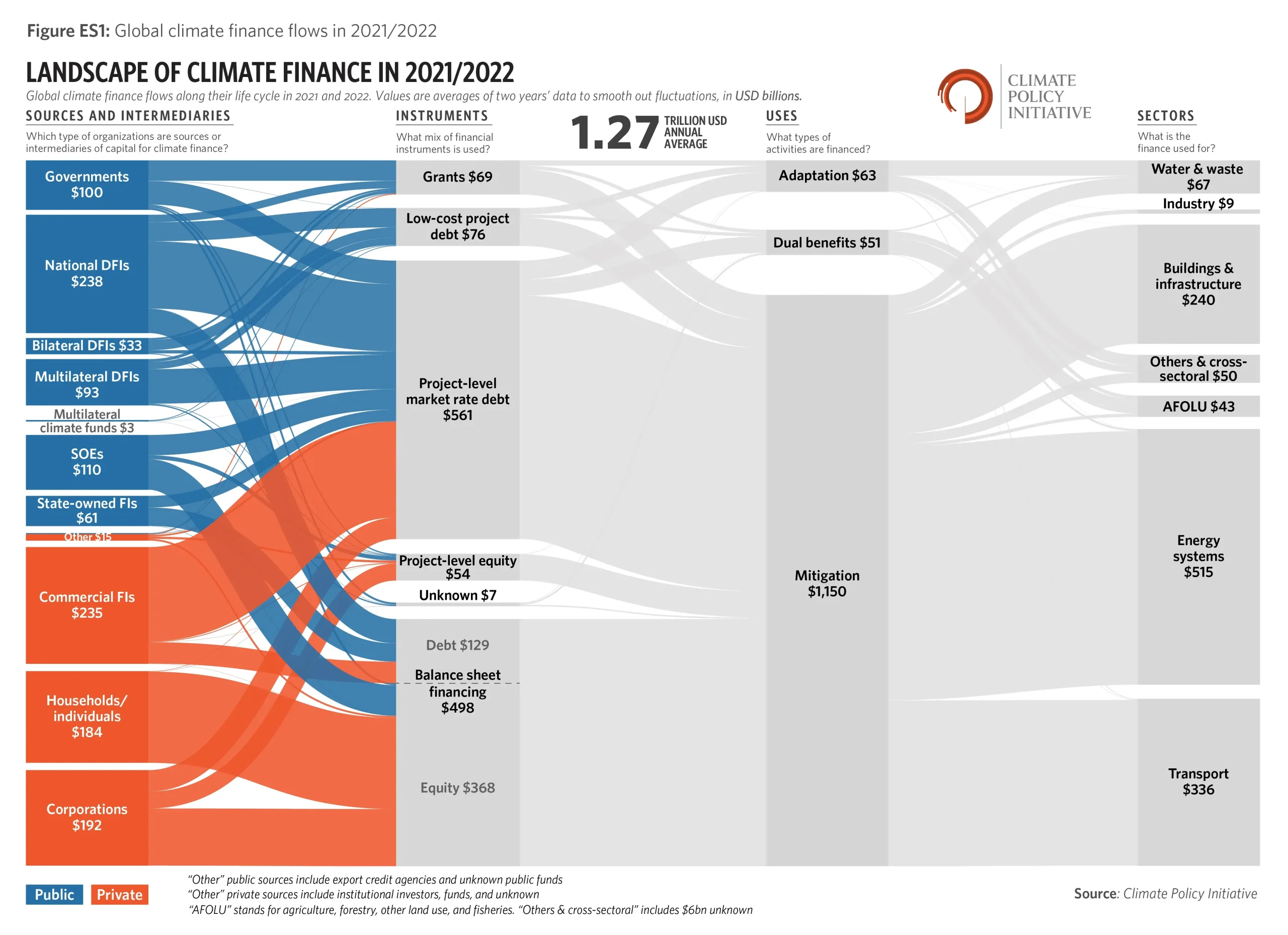

Climate finance explained as a concept refers to the flow of funds—public, private, and philanthropic—dedicated to addressing climate change. This evolving mix includes debt, equity, grants, guarantees, and insurance products that support mitigation and adaptation efforts. By weaving together national budgets, development bank instruments, and catalytic private capital, climate finance aims to mobilize the trillions needed to accelerate clean energy, resilient infrastructure, and sustainable development.

Public finance for climate action provides the foundation: grants and concessional loans from governments and international institutions help de-risk projects, spark early-stage deployment, and set policy environments that embrace low‑carbon technologies. Private finance then scales these efforts through instruments like green bonds and sustainability-linked loans, guided by sustainable finance principles that align financial returns with environmental and social outcomes. When public funds catalyze private investment, the result is a leverage effect that expands capacity beyond what public coffers alone could achieve.

This blend of sources also underscores the practical reality that climate finance explained involves more than money: it requires governance, disclosure, and accountability. Investors increasingly demand climate risk disclosure and measurable co-benefits—such as job creation and improved air quality—creating a virtuous cycle where leverage and scalable impact reinforce each other. In short, climate finance is the toolkit that translates climate goals into bankable, bank-backed projects at scale.

Sustainable Finance in Action: Green Bonds, Public Finance for Climate Action, and Blended Finance for Climate

Sustainable finance puts climate and societal goals at the center of investment decisions. In practice, it combines rigorous risk assessment with transparent reporting, ensuring that capital supports renewable energy, energy efficiency, and resilient infrastructure while meeting ESG criteria. Instruments like green bonds emerge as efficient channels to fund climate projects, illustrating how sustainable finance can mobilize large pools of capital for steady, low‑carbon growth. Public finance for climate action often complements these efforts by providing concessional terms, grants, or guarantees that improve project bankability in key sectors.

Blended finance for climate is a crucial mechanism for unlocking private investment where it would otherwise be scarce or prohibitively expensive. By layering concessional public or philanthropic funds with private capital, blended finance reduces risk, lowers the cost of capital, and can include first‑loss guarantees or catalytic grants that de-risk pilot ventures. This approach helps crowd in traditional financiers and accelerates the deployment of scalable solutions in renewable energy, climate-resilient infrastructure, and sustainable transport, all while maintaining strong governance and impact reporting.

For policymakers and investors alike, sustainable finance means building a robust pipeline, aligning with climate plans, and ensuring that financing arrangements deliver measurable climate impact. The practical path includes clear project pipelines, transparent climate risk disclosure, and governance structures that track progress against emission reductions and resilience goals. When blended finance for climate is executed thoughtfully, it catalyzes private returns in a way that public finance for climate action can be sustained and expanded over time, contributing to a healthier planet and stronger long‑term economic resilience.

Frequently Asked Questions

What is climate finance and why is it important for sustainable development?

Climate finance is the flow of public, private, and philanthropic funds dedicated to reducing emissions and adapting to climate impacts. It includes public finance for climate action, private finance (including green bonds), and blended finance for climate. Climate finance explained shows how these instruments mobilize capital for renewable energy, energy efficiency, resilient infrastructure, and nature-based solutions, helping align investments with sustainable finance and ESG goals.

What are the main sources and instruments used in climate finance today?

Public finance for climate action—grants, concessional loans, and guarantees—helps de-risk early-stage projects and attract private capital. Private finance, including green bonds, sustainability-linked loans, and equity, funds most climate investments. Blended finance for climate combines public or philanthropic funds with catalytic private investment to scale projects, guided by sustainable finance principles.

| Aspect | Key Points | Mechanisms & Examples |

|---|---|---|

| What is Climate Finance? |

|

|

| Why Climate Finance Matters |

|

|

| Sources and Mechanisms of Climate Finance |

|

|

| Key Concepts in Climate Finance Explained |

|

|

| Practical Pathways for Action |

|

|

| Case Examples and Lessons Learned |

|

|

| The Challenge of Implementation |

|

|

| The Role of Stakeholders |

|

|

| A Practical Guide for Getting Involved |

|

|